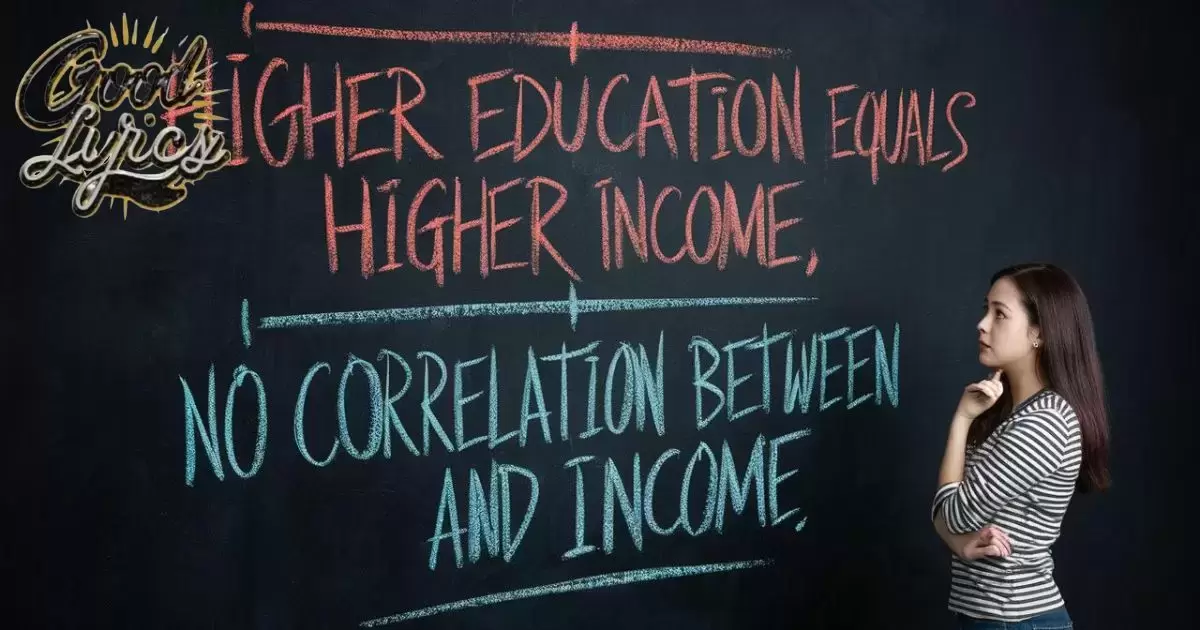

Which of the Following Statements is True About Education and Lifetime Earnings?

Generally, the more education you receive, the higher your lifetime earnings will be.

The link between education and lifetime earnings has long been a subject of intense debate and scrutiny. As we delve into this complex topic, we’ll uncover the intricate relationship between academic achievement and financial success. Buckle up for a journey through the world of degrees, dollars, and dreams!

Table of Contents

ToggleThe Correlation Between Higher Education and Increased Lifetime Earnings

Let’s face it: we’ve all heard the adage “Stay in school, kids!” But is there real meat to this age-old advice? Turns out, there’s more truth to it than you might think.

You may want to Read: 5 Benefits of Using a Term Insurance Calculator

Key Takeaways

- Higher education levels are strongly associated with increased lifetime earnings.

- Advanced degrees can lead to a significant boost in salary potential.

- The earnings gap between high school graduates and college degree holders widens.

Understanding the Earnings Gap Across Education Levels

It’s no secret that those with more education tend to earn more. But just how big is this gap? Well, it’s pretty sizeable. According to recent studies, the difference in lifetime earnings between a high school graduate and someone with a bachelor’s degree can be upwards of a million dollars. That’s not pocket change!

This gap isn’t just about the diploma, though. It’s about the skills, networks, and opportunities that come with higher education. Think of it as a snowball effect, the more you learn, the more you earn, and the more doors open for you.

The Tangible Benefits of Obtaining Advanced Degrees

Now, let’s talk about those fancy advanced degrees. MBAs, PhDs, JDs – they’re not just alphabet soup. These advanced qualifications can supercharge your earning potential.

For instance, take a look at this comparison:

| Degree Level | Median Weekly Earnings |

|---|---|

| High School | $746 |

| Bachelor’s | $1,248 |

| Master’s | $1,497 |

| Doctoral | $1,883 |

| Professional | $1,861 |

Source: U.S. Bureau of Labor Statistics, 2020

As you can see, the jump from a bachelor’s to an advanced degree is significant. But remember, these are just averages. Your mileage may vary depending on your field, location, and other factors.

Examining the Return on Investment for Higher Education

“But wait,” you might say, “college is expensive!” And you’re right. Considering the return on investment (ROI) when considering higher education is crucial. This means weighing the costs of tuition, books, and lost income during study against the potential for increased earnings over your lifetime.

The good news? For most people, the ROI on higher education is positive. A Federal Reserve Bank of New York study found that the average ROI for a bachelor’s degree is about 14% annually. That’s better than the stock market’s average return!

Navigating the Trade-Offs: Tuition Costs vs. Long-Term Financial Gains

Let’s not sugarcoat it, college can be pricey. The average annual cost of tuition at a private four-year college in the U.S. is over $35,000. Public institutions are cheaper, but still not exactly chump change. So how do you balance these upfront costs with the promise of future earnings?

It’s all about perspective. Think of education as an investment in yourself. Like you’d research a stock before buying, do your homework on potential majors and career paths. Some fields offer better returns than others. For example, STEM (Science, Technology, Engineering, and Mathematics) fields often boast higher starting salaries and better job prospects.

But remember, it’s not just about the money. Your education should also align with your passions and goals. After all, you’ll spend much of your life in your chosen career.

The Importance of Education in Opportunities for Career Advancement

Education isn’t just about that first job out of college. It’s about setting yourself up for long-term success and growth. Higher levels of education often correlate with increased opportunities for career advancement.

You may want to Read: Wellhealthorganic.com: Morning Coffee Tips With No Side Effect

Lifelong Earnings: A Comparison of High School Diploma and College Degree

Let’s break it down. Over a lifetime, the earnings gap between high school graduates and college degree holders is stark. The Social Security Administration estimates men with bachelor’s degrees earn about $900,000 more in median lifetime earnings than high school graduates. For women, that gap is about $630,000.

But it’s not just about the total sum. College graduates often see their earnings increase more rapidly over time. They’re more likely to receive promotions, bonuses, and other perks that can significantly boost their income.

The Impact of Critical Thinking and Problem-Solving Skills Acquired Through Education

Here’s something that often gets overlooked: education isn’t just about facts and figures. It’s about developing critical thinking and problem-solving skills that are invaluable in the workplace. These skills make you more adaptable, innovative, and valuable to employers.

As automation and AI reshape the job market, these “soft skills” become even more crucial. They set humans apart from machines and make us irreplaceable in many roles.

Achieving Financial Stability: Education’s Role In Minimizing Student Debt and Loan Dependency

Now, let’s address the elephant in the room: student debt. It’s a hot topic, and for good reason. The average student loan debt in the U.S. is around $30,000. That’s a hefty sum, but it mustn’t be a life sentence.

You may want to Read: Wants and Needs Lyrics – Drake ft. Lil Baby

Education can play a role in minimizing debt in the long run. How? You’re better equipped to pay off loans quickly by increasing your earning potential. Plus, many high-paying jobs offer loan repayment assistance as a perk.

Moreover, financial education, whether formal or self-taught can help you make smarter decisions about borrowing and repayment. Understanding compound interest, budgeting, and investing can prepare you for long-term financial success.

FAQs

Does instruction have a critical effect on lifetime profit?

Absolutely! Education significantly boosts lifetime earnings. Studies show college grads earn up to $1 million more over their careers than those with just high school diplomas.

Do men and ladies with higher instruction win more than those with lower instruction?

You bet! Both men and women with higher education consistently out-earn their less-educated peers. The wage gap narrows but persists across genders.

Does instruction play a part in riches amassing?

Indeed it does! Education equips you with skills, networks, and opportunities that fuel wealth accumulation. It’s like compound interest for your career prospects.

Does the desire for higher lifetime profit impact choices almost higher instruction?

No doubt about it! Many folks pursue higher ed specifically to increase their earning potential. It’s a major motivator in career planning and educational investments.

Are the financial benefits of instruction long-term?

You’d better believe it! Education’s payoffs extend far beyond your first job. Higher degrees often lead to faster career advancement, better job security, and increased earning power over decades.

Conclusion

while the relationship between education and lifetime earnings is complex, the evidence overwhelmingly suggests that higher education leads to increased earning potential. But remember, it’s not just about the degree. it’s about the skills you develop, the networks you build, and the opportunities you create for yourself.

So whether you’re considering college, contemplating an advanced degree, or just curious about the economic impact of education, remember: knowledge truly is power; in this case, it can also mean prosperity.

Stay updated with the latest news and trending topics on my blogging website. From breaking stories to in-depth analyses, I bring you the most relevant updates concisely and engagingly!